-40%

AI based / Automated Elliott Wave Trading Algorithms

$ 938.66

- Description

- Size Guide

Description

You are about to acquire decades and millions worth of deep research into Elliott Wave causality and Artificial Intelligence combined and condensed into a small set of Boolean logic algorithms which you can apply to any market and any time frame.All examples shown are applying the AI Elliott Wave trading logic to the 10 minute e-mini S&P 500 and 15 minute S&P 500 / U.S. Dollar Forex spread, but you can adjust the parameters to any market and time frame based on your own research.

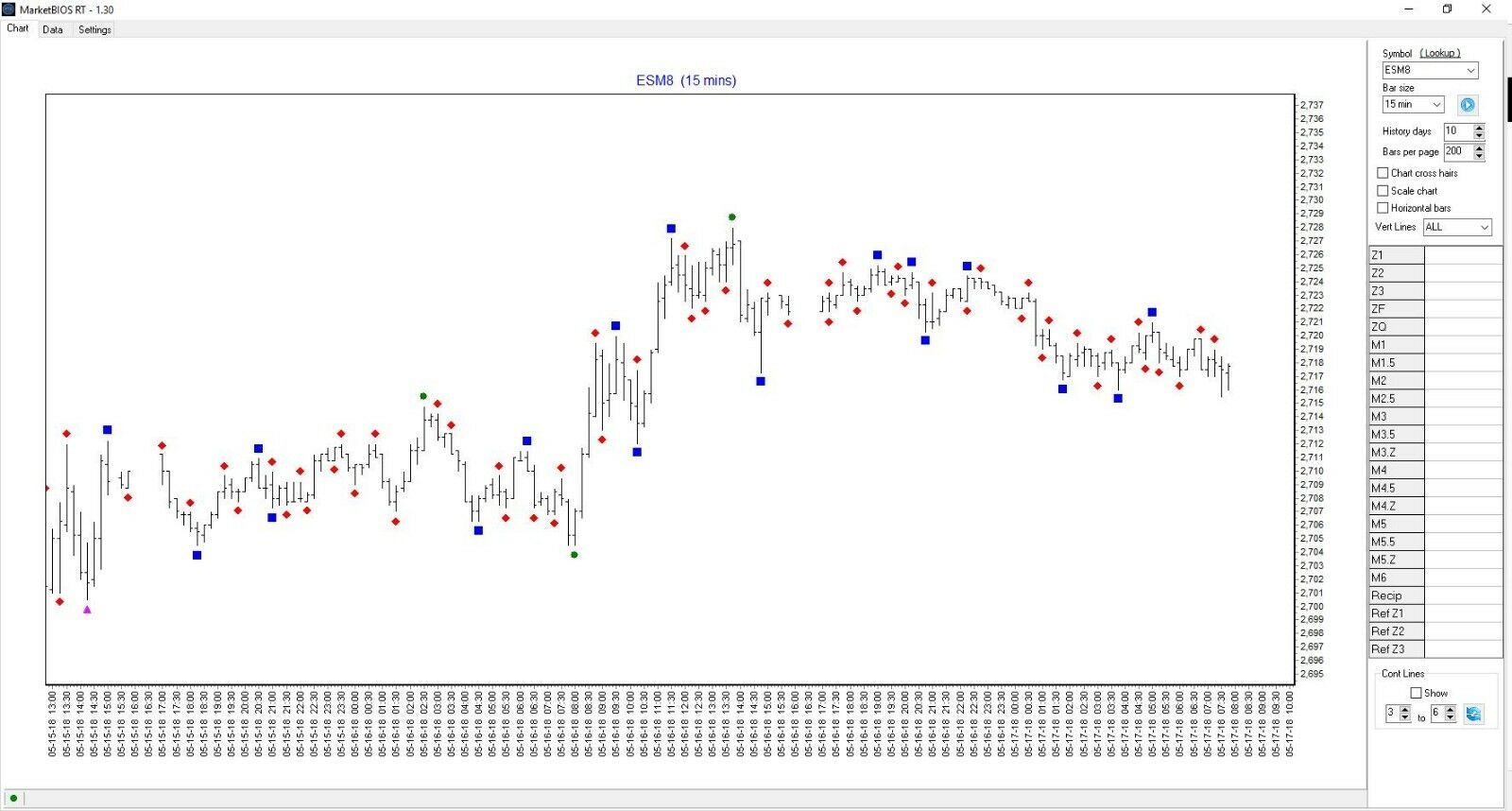

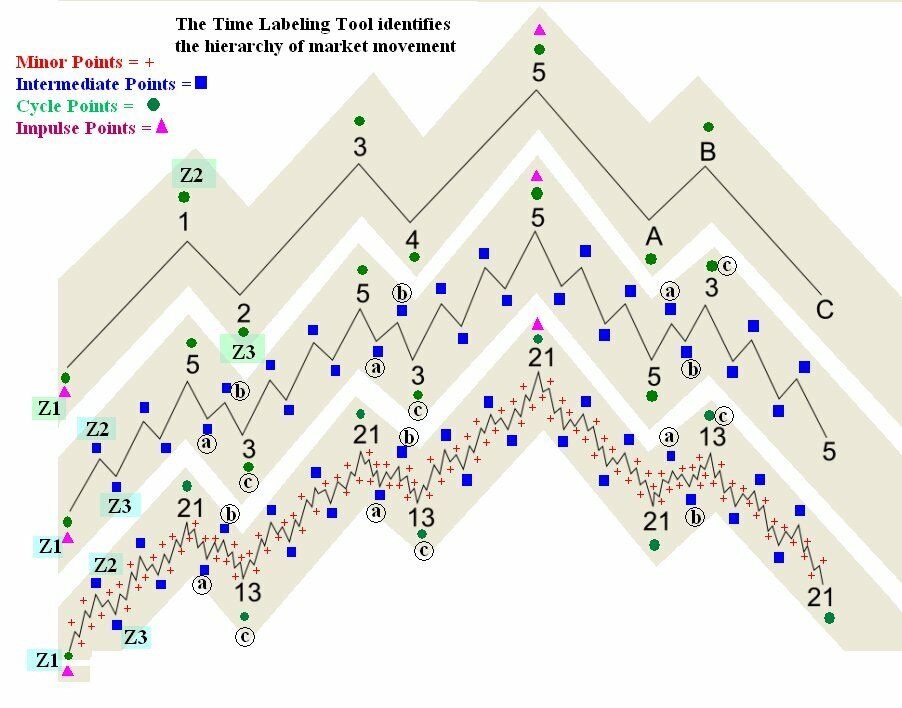

You will learn that market price behavior generates it's own hierarchy of movement, which is identified with our proprietary Time Labeling method which strips the subjectivity from Elliott Wave counting. The Time Labeling tool uses colored markers to identify the hierarchy of price movement.

In essence - it's the same AI perception logic used in autonomous driving vehicles - which identifies objects and the vehicles' correct path - so it doesn't hit objects and travels safely down the road. Using another comparison - the Time Labeling Tool identifies the flocking behavior path in which price moves through time.

Furthermore in our research, the Time Labeling Tool method was used to identify and indicate whether market price behavior was in the process of developing primary Elliott Waves 1 and 3 or corrective moves A and B - which we termed Z1, Z2 and Z3.

The idea was to simply wait until for the completion of Elliott Wave's 1 and 2 to capture the price movement generated in Wave 3 or Wave 5. Or, whether a market was generating Elliott Waves A and B, before a predictable move in the opposite direction to generate Waves 3 and Wave 5.

In addition, the price length of Z1 to Z2 and Z3 was used to project the expect price lengths of Wave 3 and Wave 5 in the future. Those calculations and measurements were called the "Z Factor" calculations, named after a researcher who provided a "Eureka" movement while doing the research.

See the image included in the posting showing the Time Label hierarchy.

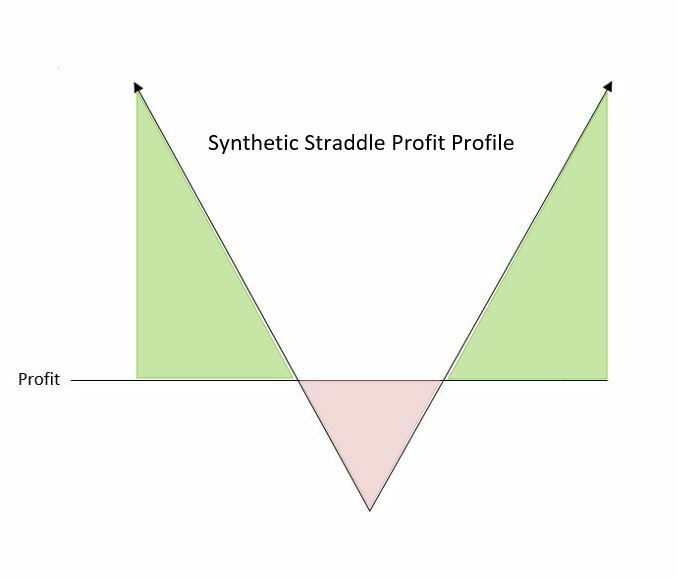

We also discovered that not only does the price length of Z1 to Z2 to Z3 identify and project expected price movements in the future, but were also applicable to identify the dynamically changing volatility in price and expected return - which can be used in options trading, and when managing multiple markets and large portfolios.

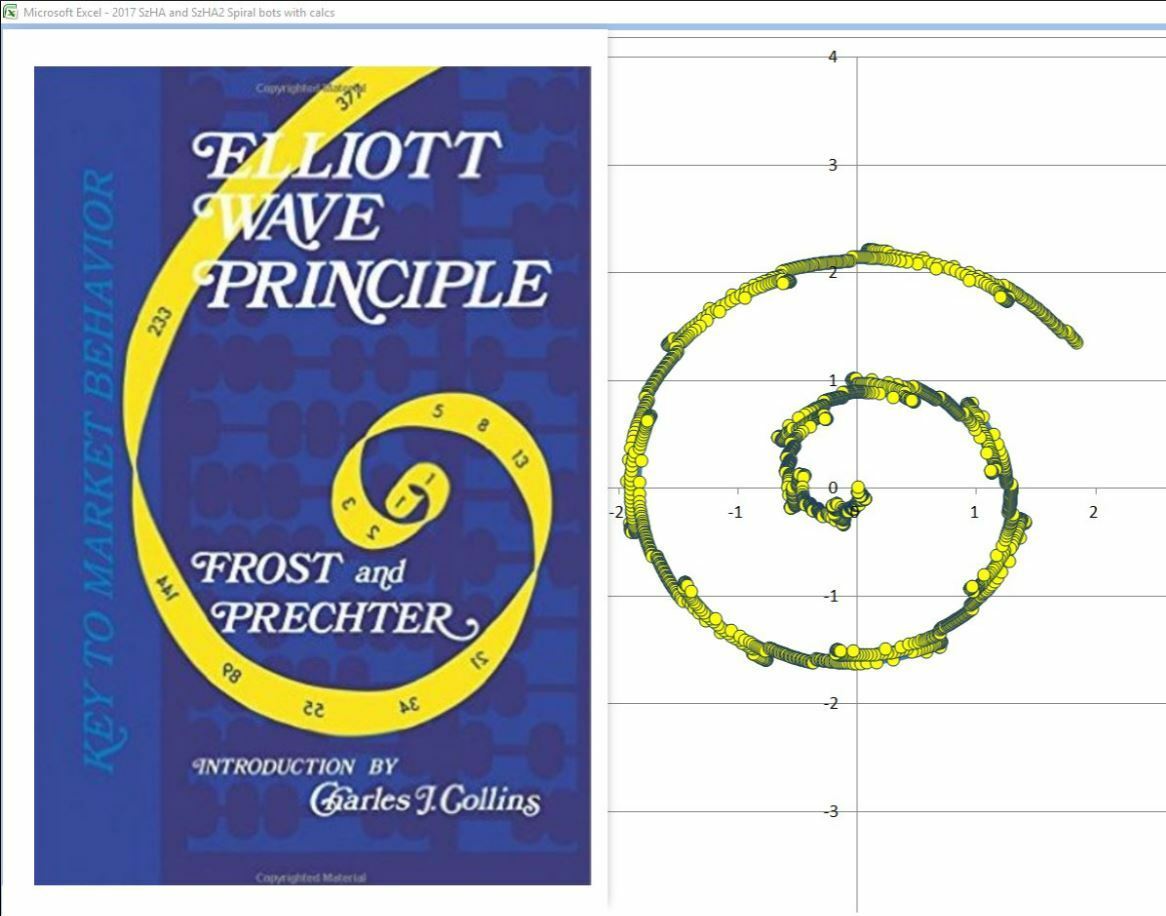

Due to another "breakthrough" we discovered the "thing" known as the Elliott Wave or Fibonacci spiral and it's effect and human behavior was directly related to planet Earth spiraling through space - as Earth travels in its' spiraling motion in it's orbit!

Several years of rigorous quantitative research in various aspects of math and astrophysics were explored using NASA data to compare and correlate market price behavior to the predetermined and pre-computed rotational characteristics of Earth spiraling through space in 10 minute and hourly increments. The outcome of those experiments was rather convincing.

However, the underlying physics in quantum phase dynamics, known as the "Berry Phase", generated an inverse correlation or "flipping effect" when specific stages in the rotation were reached.

To account for that inverse effect - the Time Labeling Tool was used as a "gauge" to capture those periods when price moved OPPOSITE the spiral rotation. Through another stage of rigorous comparative research another "Eureka" moment occurred!

We were once again back to "Square One" after realizing there was

NO NEED

to use the predictive spiral computations! The Time Labeling Tool logic as the basis for the decision logic, generated better results AND could be structured in a condensed set of algorithms to capture Elliott Wave based trading

AUTOMATICALLY

!

To clarify - the underlying Time Labeling Tool structure was the basis, and condensed into a small set of Boolean logic algorithms which only capture directional moves in price - Elliott Waves 1, 3 and 5! With

NO subjectivity

! The algorithms automatically tell you the precise price to enter and the precise moment to exit your trades.

After further research the results obtained using the AI based Boolean logic was REMARKABLE and quite unbelievable! The AI based logic captured and condensed decades and millions of dollars worth of research in an easy to use and understand format!

Again - it was a truly startling "Eureka" moment when hit with the sudden realization that all the work could be condensed so easily into the simple set of Boolean logic algorithms! Trust me - I suddenly thought

"Why didn't I think of this DECADES AGO!"

So then - this is an opportunity to acquire decades worth of research, writing, computing and research into artificial intelligence for your own use and trading.

Now - you may ask why I haven't contacted Robert Prechter to show him the deep body of work we've compiled, which would help him grasp the causal relationship between Earth's rotation as it spirals through space in its' orbit, market price behavior and the AI based Elliott Wave trading algorithms.

The

TRUTH

is - I have contacted him and others on this team, and he has never replied to any of my attempts to reach him.

In addition - I've tried my best sharing this research with small and large hedge funds who always ask me to just give them the algorithms FREE - and let them implement the trading technology themselves. Yes - I have tried to share the work with them, but they quickly refuse to reply to my follow up contacts.

In other words, I've learned first hand hedge funds, mutual fund and money managers have a deep

"not invented here"

mentality and refuse to consider concepts they didn't learn from a college textbook.

That's GOOD NEWS for you!

Rather than continue pestering professionals in the industry to partner with them, I've decided to share decades worth of research, writing, computing and artificial intelligence with you! Rather than continue to keep this proprietary body of research "secret" and in hiding - you can now use it for your own trading.

One large hedge fund offered ,500,000 for the entire body of work - but they reneged after deciding that the concepts I described were outside their boundaries of thinking - even though they continue to generate

terrible returns for their investors

.

With all that aside - here's what you'll get:

You'll get the Elliott Wave trading Excel spreadsheet which includes 10 minute S&P 500 data, research and the algorithms with all the logic you can use. If you're capable, program the algorithms in your favorite on-line trading platform. The spreadsheet includes results going back to January 1st, 2015 and two additional strategies to increase your position size as the market moves directional or accumulates gains over time.

You'll get a white paper describing all the algorithms and components you need to translate the algorithms to your own program.

You'll get three different strategies to apply the logic. The examples shown trade the e-mini S&P 500 futures contract both long and short when market price hits order execution parameters.

A free subscription to the SaaS / browser based Market BIOS application which is connected to Amazon cloud. However, the data vendor only provides delayed data and you'll have to subscribe to their data stream, which costs about 0 per month.

You'll get all research documents and white papers describing how the Time Labeling Tool and Z calculations combine to identify dynamically computed Elliott Wave projections. Here's the "thing" though -

you won't need them

! All you need are the AI based Elliott Wave trading algorithms in which those elements are automatically accounted for in the trading logic.

You'll get a separate spreadsheet to compute the Spiral, along with 10 minute NASA data to the year 2100, to track the Earth's spiral through space in 3 dimensions. But you really don't need it! All you need are the Boolean logic-based Elliott Wave trading algorithms.

You'll get 100's of research papers on various topics in physics and astrophysics, if you'd like to pursue research into the Spiral physical effects on human behavior

You'll get a variety of books, academic papers and industry papers pertaining to artificial intelligence - including tops like flocking behaviors, reinforcement learning, artificial perception, etc.

In other words, you'll get a lifetime of learning and your own research library contained on the flash drive you'll get if you choose to move forward.

Next - if you have any questions, please message me and I'll also send you a Elliott Wave AI logic performance spreadsheet which includes the trading results when applying the Elliott Wave trading algorithms to the e-mini S&P 500 in 10 minute increments.

That leads me to another aspect of the research: we quickly discovered using 10 minute intraday trading generated much better results compared to applying the trading logic to daily data. That makes sense though, since the intra-day ranges and price moves are smaller and generates more trades in small price increments, compared to the daily data which trades much less frequently than the intra-day data, with slower price movement.

In other words, 2 to 3 days of 10 minute data replicates about one year in daily data, but contained within smaller price ranges.

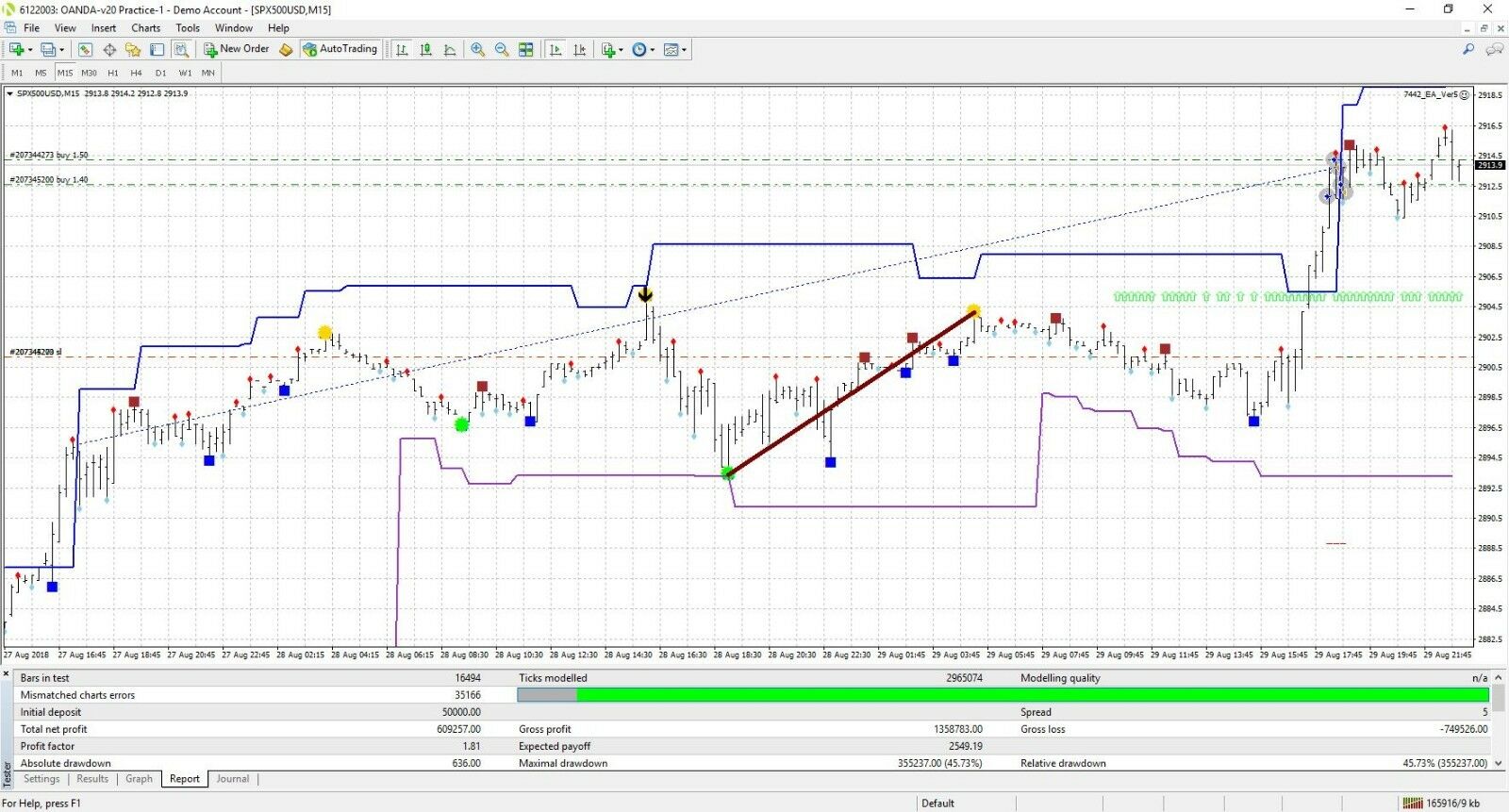

To clarify further, the attached snapshots include the trading logic programmed and auto-trading in "Demo" mode using MetaTrader, applied to the 15 minute S&P 500 / U.S. Dollar Forex spread. Note the net year to date profit shown going back to January 1st: 9,257. That profit is generated with customized parameters based on adding to one's position as profits accumulates, using a 2% risk parameter: 2% of trading equity is the maximum risk for each initial trade.

However - the MetaTrader application is not include in this offer.

Here's the "thing" - an acquaintance programmed that application for me whom lives in Canada. I'm told U.S. citizens are not allowed to trade the S&P 500 / U.S. Dollar Forex spread.

You could create a similar auto-trading application yourself in a similar platform.

Again - before you decide to purchase - please message me with any questions and I'll be happy to answer you, and will provide you with a performance spreadsheet showing results going back to 2015.

Watch the AI algorithms trade real time - simply click the link:

https://www.youtube.com/watch?v=fHV048udBI0

As you probably know already:

RISK DISCLOSURE:

Futures and forex trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing ones financial security or life style. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results.

HYPOTHETICAL PERFORMANCE DISCLAIMER:

HYPOTHETICAL PERFORMANCE RESULTS HAVE MANY INHERENT LIMITATIONS, SOME OF WHICH ARE DESCRIBED BELOW. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFITS OR LOSSES SIMILAR TO THOSE SHOWN; IN FACT, THERE ARE FREQUENTLY SHARP DIFFERENCES BETWEEN HYPOTHETICAL PERFORMANCE RESULTS AND THE ACTUAL RESULTS SUBSEQUENTLY ACHIEVED BY ANY PARTICULAR TRADING PROGRAM. ONE OF THE LIMITATIONS OF HYPOTHETICAL PERFORMANCE RESULTS IS THAT THEY ARE GENERALLY PREPARED WITH THE BENEFIT OF HINDSIGHT. IN ADDITION, HYPOTHETICAL TRADING DOES NOT INVOLVE FINANCIAL RISK, AND NO HYPOTHETICAL TRADING RECORD CAN COMPLETELY ACCOUNT FOR THE IMPACT OF FINANCIAL RISK OF ACTUAL TRADING. FOR EXAMPLE, THE ABILITY TO WITHSTAND LOSSES OR TO ADHERE TO A PARTICULAR TRADING PROGRAM IN SPITE OF TRADING LOSSES ARE MATERIAL POINTS WHICH CAN ALSO ADVERSELY AFFECT ACTUAL TRADING RESULTS. THERE ARE NUMEROUS OTHER FACTORS RELATED TO THE MARKETS IN GENERAL OR TO THE IMPLEMENTATION OF ANY SPECIFIC TRADING PROGRAM WHICH CANNOT BE FULLY ACCOUNTED FOR IN THE PREPARATION OF HYPOTHETICAL PERFORMANCE RESULTS AND ALL WHICH CAN ADVERSELY AFFECT TRADING RESULTS.